Why Platinum Is The Most Expensive Metal

Diesel vehicle sales in Europe are projected to increase and consequently cause a significant rise in platinum consumption in the region from 2004 onward. Tightened emissions regulations in China, Europe, Japan and other regions are expected to result in a higher average platinum loading in catalytic converters. This increase is most notable in light diesel vehicles given stricter particulate emission controls.

In the United States, manufacturers continue to achieve cost savings, which is expected to lead to a decrease in platinum usage in automotive catalysts. The price difference of more than $600 per fine ounce between palladium and platinum has led to the view that automotive manufacturers will adjust the alloy composition in spark-ignition engines. This adjustment is anticipated to favour palladium over platinum.

Palladium usage in the automotive industry is expected to increase in the short term. Average loading in catalysts in Europe and Japan is projected to rise at the expense of platinum given the introduction of stricter particulate emission standards. US automotive manufacturers reduced their palladium inventories last year, and their purchases are expected to increase.

Several US automotive manufacturers have not yet completed the transition because prices have been historically high and volatile. A shift to increased palladium usage rather than platinum for automotive catalysts in spark-ignition vehicles is expected. This shift is predicted to result in a modest increase in palladium consumption in Asia and Europe.

In Europe, the production of gasoline vehicles is expected to decline, while diesel vehicle sales are projected to rise. This growth is predicted to offset part of the anticipated increase due to the shift to palladium. Some US manufacturers may further modify the alloy ratio in favour of palladium; however, additional cost savings are expected to counterbalance this change.

In the electronics sector, component sales are expected to rise. Increased demand for palladium is partially offset by both miniaturisation and substitution with nickel and silver in ceramic multilayer capacitors. Sales of platinum jewellery are projected to decline globally because prices remain high and alternatives such as white gold and palladium are available.

In China, palladium jewellery sales are expected to increase since the price is lower than that of gold and platinum. The supply of both palladium and platinum is expected to increase considerably as a result of new mines in South Africa.

Bars

Bars

Beads & Spheres

Beads & Spheres

Bolts & Nuts

Bolts & Nuts

Crucibles

Crucibles

Discs

Discs

Fibers & Fabrics

Fibers & Fabrics

Films

Films

Flake

Flake

Foams

Foams

Foil

Foil

Granules

Granules

Honeycombs

Honeycombs

Ink

Ink

Laminate

Laminate

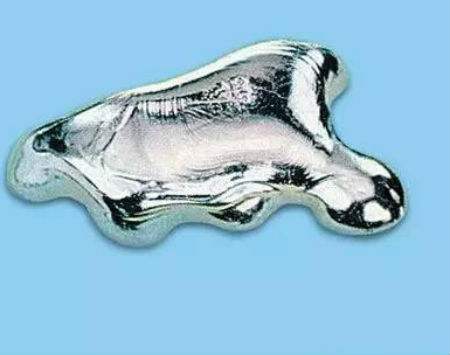

Lumps

Lumps

Meshes

Meshes

Metallised Film

Metallised Film

Plate

Plate

Powders

Powders

Rod

Rod

Sheets

Sheets

Single Crystals

Single Crystals

Sputtering Target

Sputtering Target

Tubes

Tubes

Washer

Washer

Wires

Wires

Converters & Calculators

Converters & Calculators

Write for Us

Write for Us

Chin Trento

Chin Trento